Our work shapes the external edges of the organization by shaping the software it produces. It's an aspect of the structural coupling by which organizations adapt to their ecosystems, and then the two shape each other.

Pursuing new product ideas and avenues of exploration is not so dissimilar from how a vine taps into the ground, how a network of hyphae colonizes a suitable substrate, or how a tree grows its roots.

The process of product development brings new ideas to life. For the organization to be successful in its environment, that process must be embedded in a means of organizational focus, and wrapped in appropriate sensing mechanisms and feedback loops.

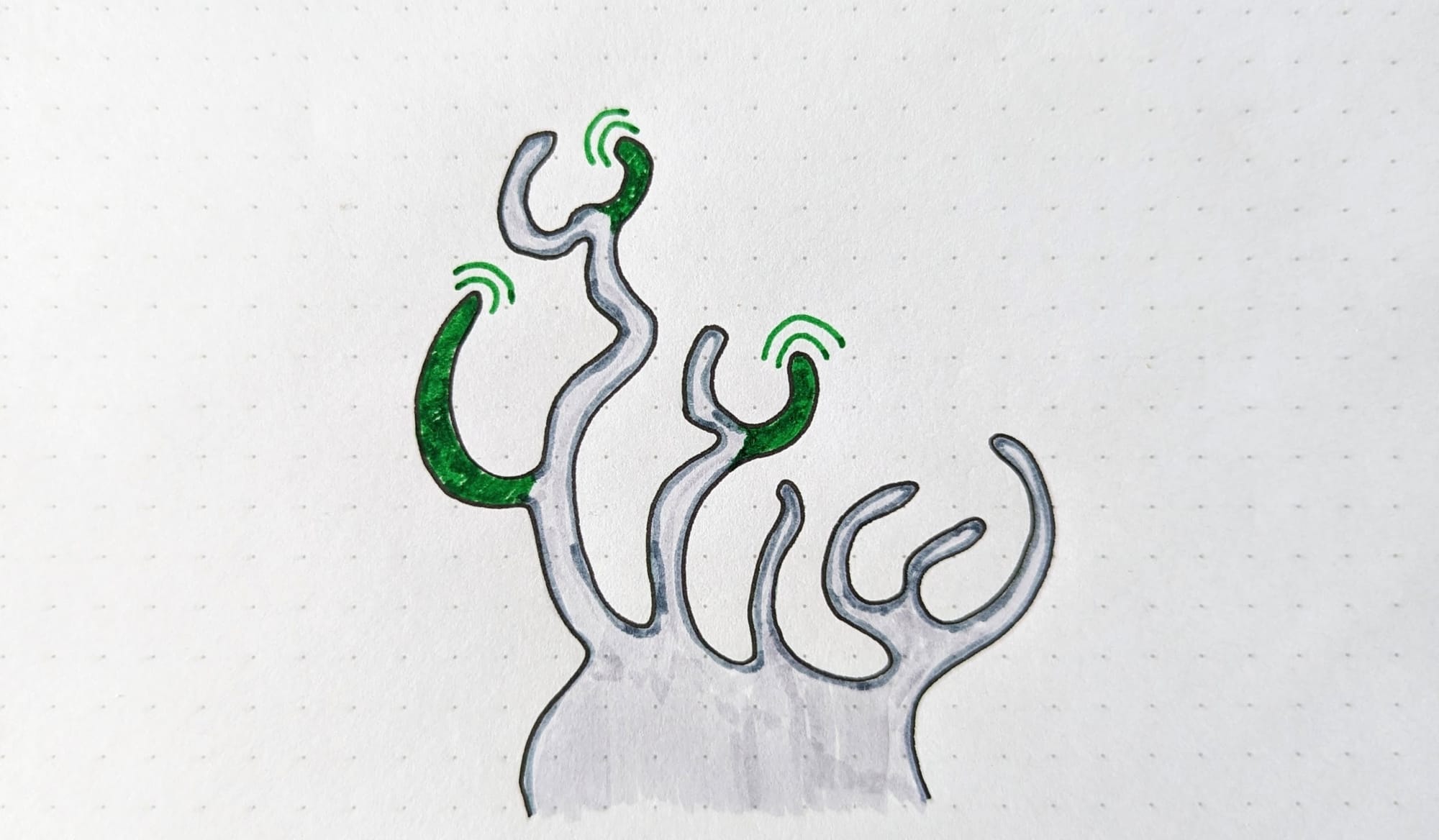

A simple startup growing its roots

Imagine a simple startup whose product expression is shaped as below. We have one main trunk, one core product area, several capabilities, and three specific feature areas in active development (green).

Assuming a modern startup, they probably employ some mode of continuous discovery as their sensing mechanism: they work with paying customers, a product advisory council, or some other arrangement for ongoing exploration of product-in-context, coupled with live user data.

The team is small; formed around a specific niche in their ecosystem, how they want to transform that area is clear. It's easy to pivot and grow into new places within their scope. The overall product surface area is manageable, and they can throw away exploratory software as quickly as they create it.

As long as there are effective environmental sensing mechanisms and the ability to explore is partnered with the ability to cull, it's a manageable mode of operation for the organization until it experiences strong external pull from the market.

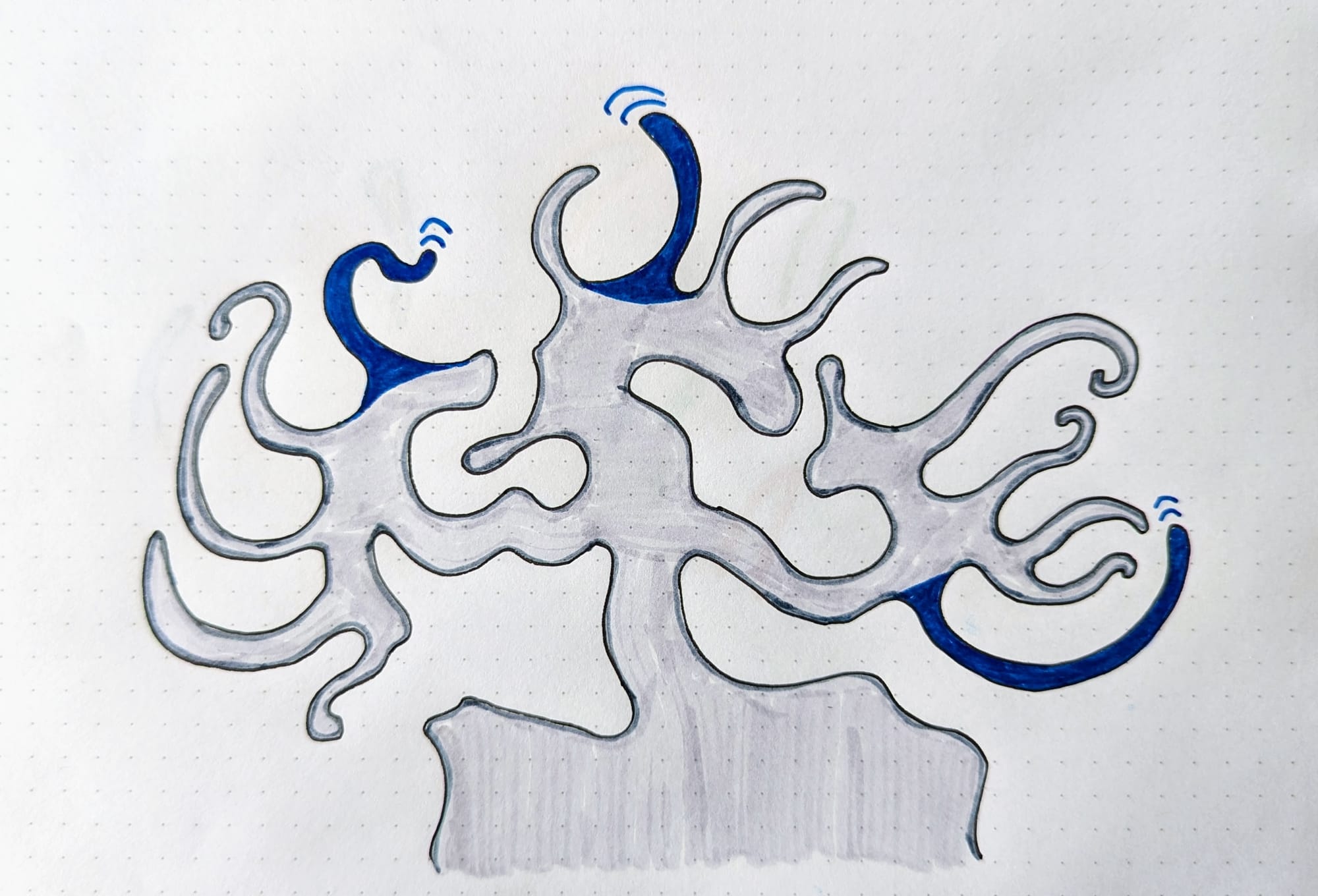

A more complex organization

The complexity of this picture shifts the moment the organization gets larger, especially as heavy use lignifies the primary paths of product activity.

The organization gains product teams, its product covers more capabilities, and valuable customers depend on more parts of the product. Every change must be orchestrated with those shaping the product and also coordinated with the agents binding the product to its external environment — sales, marketing, customer support, and legal.

The image above is simplistic: one team, one focus (blue). In reality, teams that cover an entire user group or product area work across multiple initiatives and goals.

Their work must also talk to other teams' capabilities, integrate with existing functionality and workflows, fit users' needs and expectations, and attempt to avoid duplication. Just as the team works in one area adjacent to other teams, other teams work in areas adjacent to theirs.

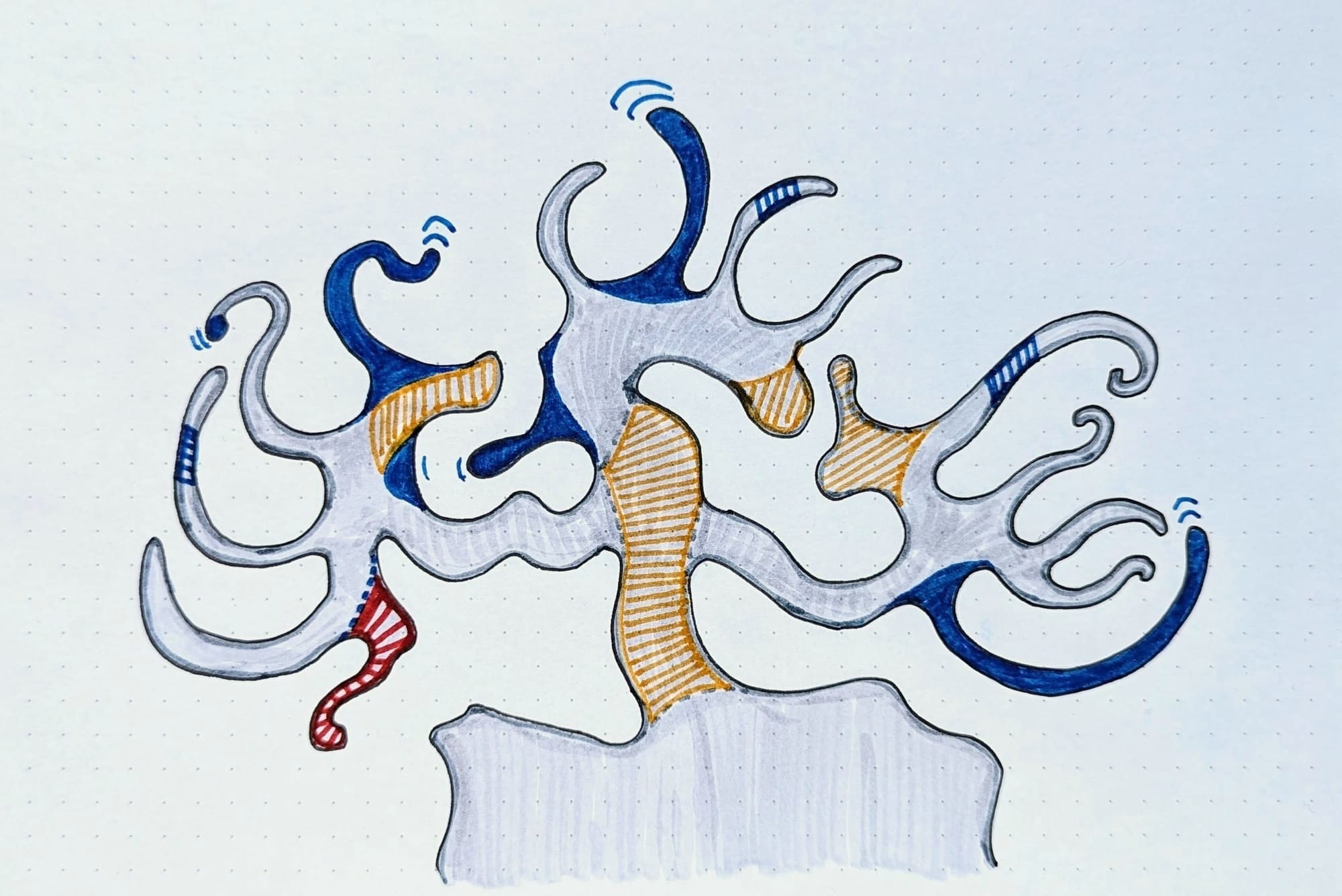

Perhaps the picture is more like this, below: some areas under development and maintenance (blue), one ill-formed appendage being actively removed (red), and some areas undergoing infrastructural change, integration, and rewiring (yellow).

Focused action and feedback

As the surface area grows and interactions become interdependent, focus is more important than ever. Within the scope of a single team or product area, it's easy to lose sight of the coherent whole. There's so much that we might build, as our connection to the ecosystem deepens and our adjacencies increase.

All new product work ultimately changes the expression of all adjacent areas in the organization. And everything new incurs cost: development costs, opportunity costs, upkeep costs, and complexity costs. (Smart and experienced product managers are not shy in asking "what if we just didn't do that?" or saying "that's a great idea as, long as my team doesn't own it.")

A strategic organization accounts for its existing costs, capabilities, customer engagement, and position in the ecosystem. These current state inputs plus a coherent direction for the future shape where a healthy organization explores new ideas and grows forth. A well-understood and shared picture of the organization and its ecosystem offers a path to necessary focus.

Revenue performance, customer feedback, instrumentation and analytics, support engagement, market insight, sales conversations, user research, customer interviews, board feedback, continuous discovery, and competitive analysis collectively provide the inputs an organization requires to focus strategically and guide itself coherently.

The coalescing that generates focus from these inputs is less a static story and more a moving picture: we maintain situational awareness with sensing mechanisms, feedback loops, and a means of collating and consolidating this information in ongoing cycles.

The method itself doesn't matter: more important are the quality and coverage of our signals, and our ability to collectively interpret them.

Living systems seek and sense

Tree roots seek fertile and tractable ground. Vines tap deep into the earth to find the water. Fungal networks search for sustenance in their substrates, maintaining optimal pathways as they do so.

As these living systems grow, they know what they're looking for and have built-in sensitivity to whether or not they're getting it.

Our organizations grow as living systems without, at first, inborn strategic focus or well-oiled mechanisms for sensing their ecosystem beyond rudimentary metrics.

Imagine: vines growing roots that can't tell where the water is.

Two things of note —

- My podcast episode of The Optimal Path was released last week: I spoke with Ash Oliver at Maze about some of my prior writing and the direction that UX Research is shifting into.

- Lisa Koeman shares a novel user journey visualization and sonification in her latest blog post. It's thoughtful, well-crafted, and opens the door to a range of new possibilities. It's great — check it out.

This is Loops and Cycles, a weekly mailing list exploring the processes that produce good products (and organizations). Share it with your team, send it to a friend, send me your thoughts and questions.

![Focus and Sense [LC03]](/content/images/size/w100/2024/04/LC03_growth-series-2.jpg)