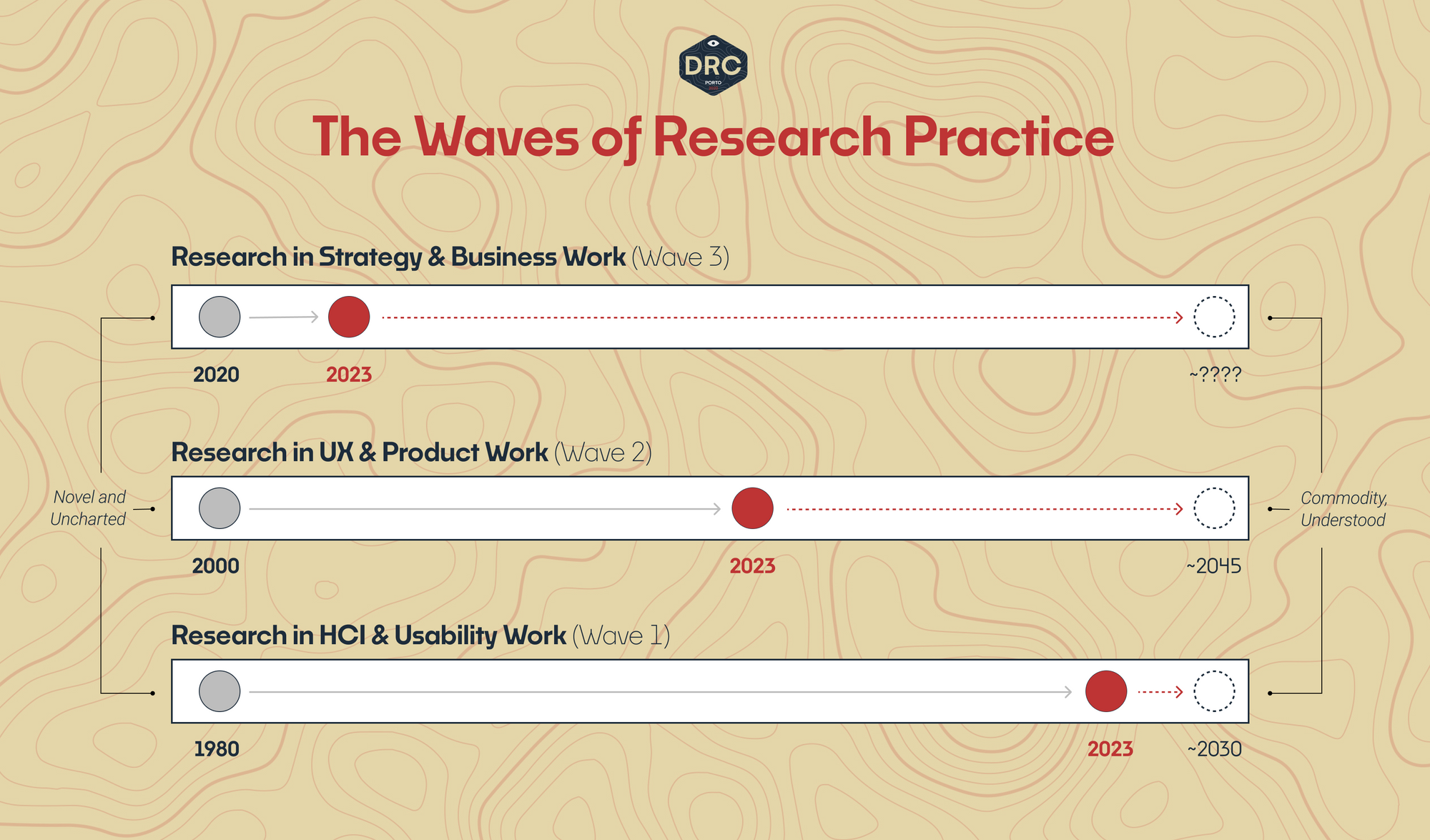

The first wave of research, receding now, grew from academia. The current wave is cresting, ready to wash over software design and product management. And third wave research will reach even higher, moving into product and organizational strategy.

Each wave inevitably consumes and builds upon the prior — they don't end, but become the foundation on which the next wave of research and adjacent forms of higher-order value will be built.

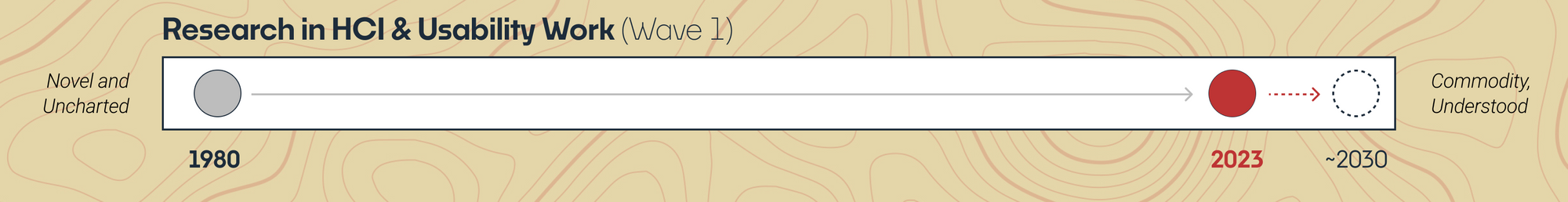

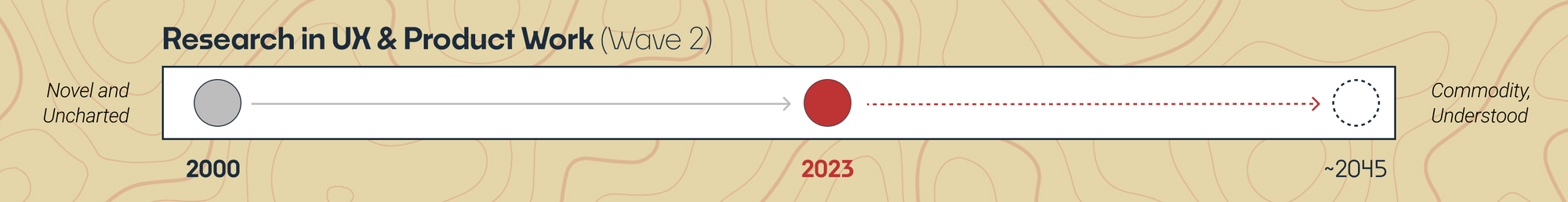

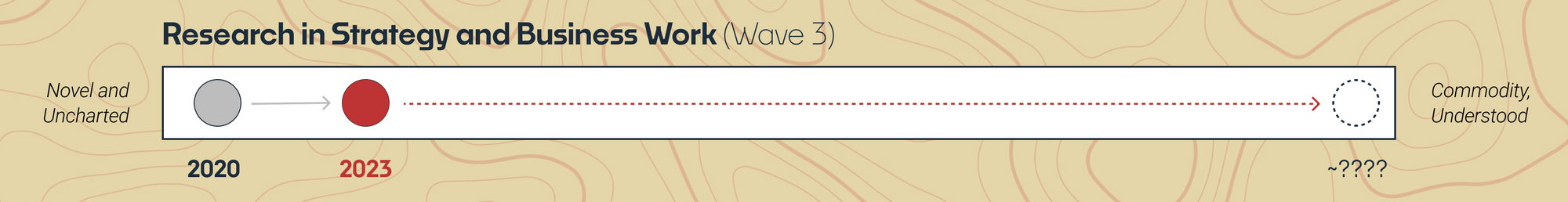

This strategic view of research examines the work in terms of its evolution — how the skills, activities, and capabilities move from novel and uncharted territory into more industrialized and commodity forms of value. (We build on the foundation of Simon Wardley's Wardley Map framework.)

For researchers on the path of practice, teams building research tools, and organizations employing research capability, these evolutionary stages are the grounding context for understanding and positioning research practice: how we invest in, develop, purchase, organize, deploy, and distribute the work. Let's take a quick snapshot of each wave's state-of-evolution as introduction.

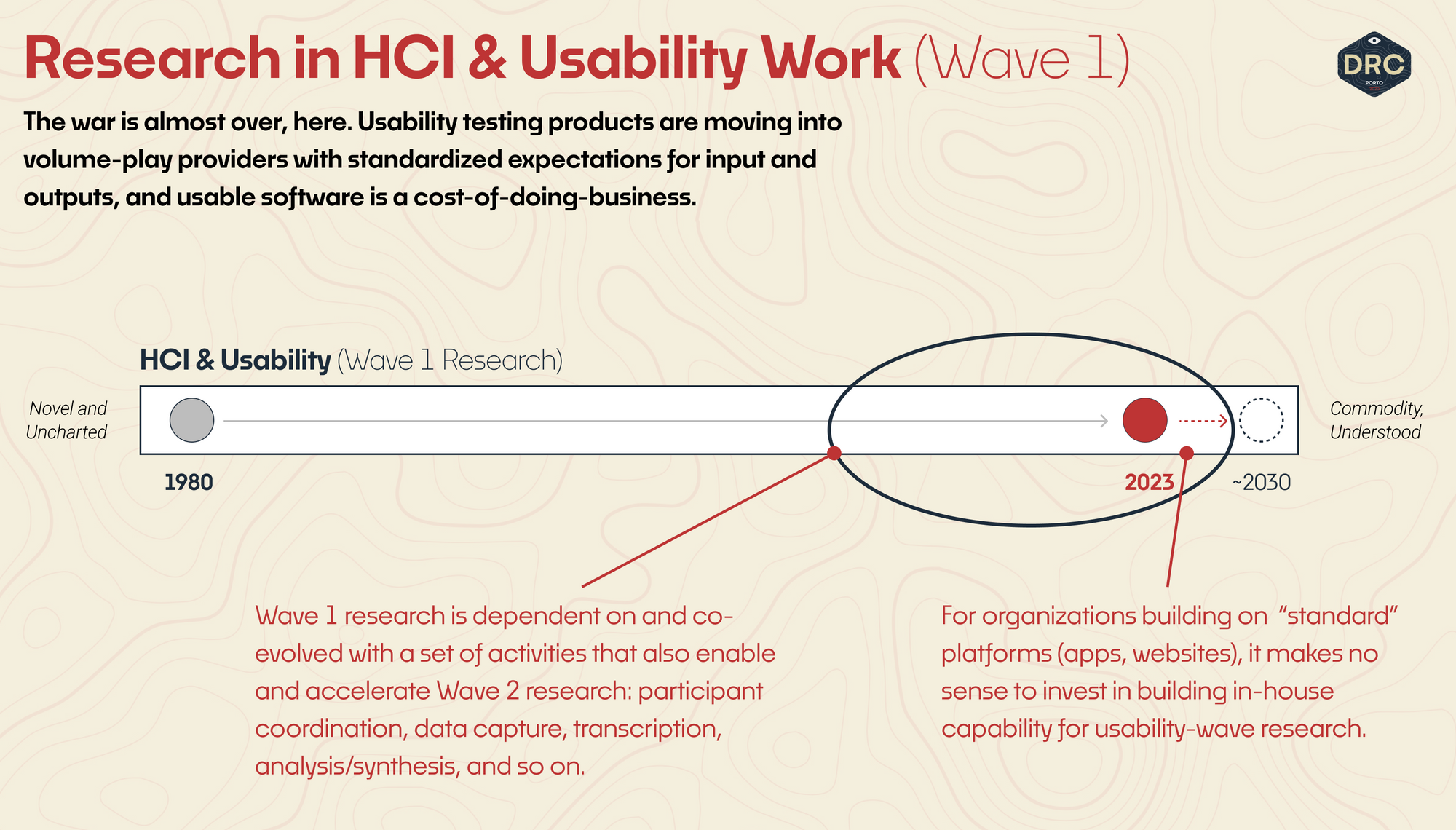

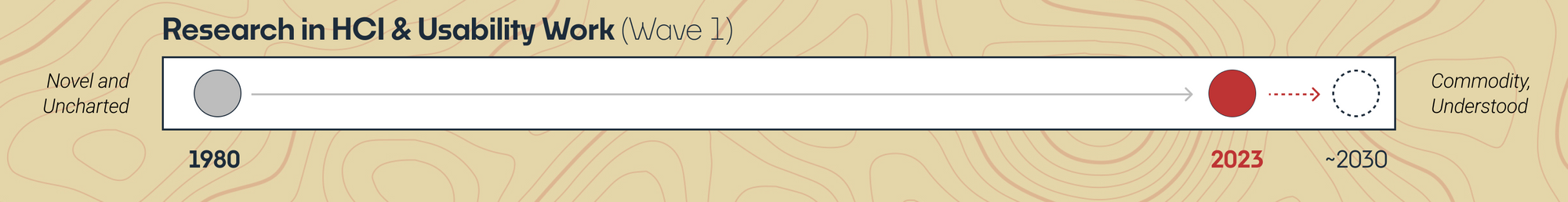

Wave 1 - The Usability Wave

Rooted in HCI, the Usability Wave is nearing diffusion into the background of our work. It's moving into wide acceptance, with ideas and practices that are well understood. Research is a known and expected form of value in the Usability Wave, shifting toward a volume play focused on operational efficiency.

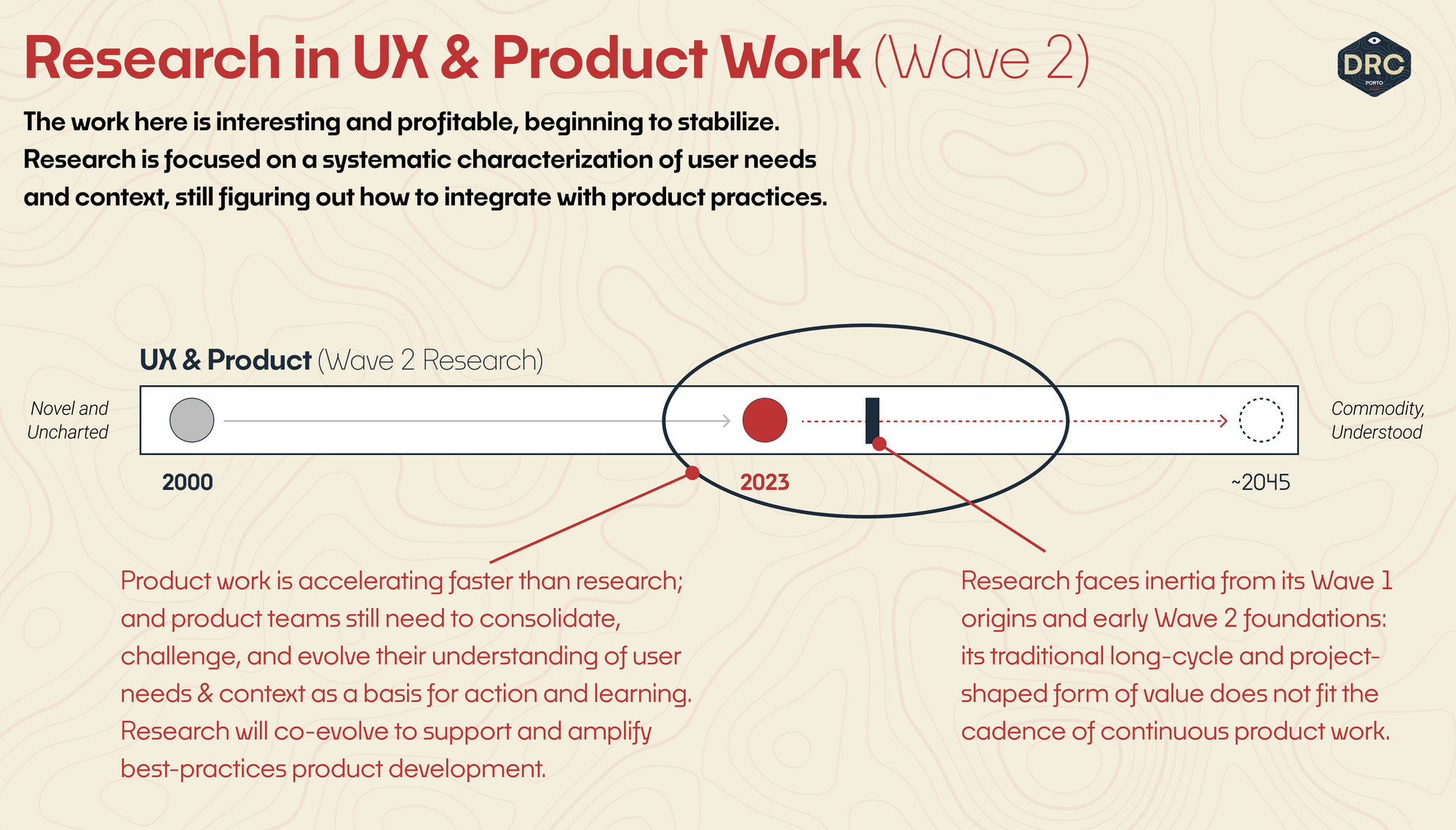

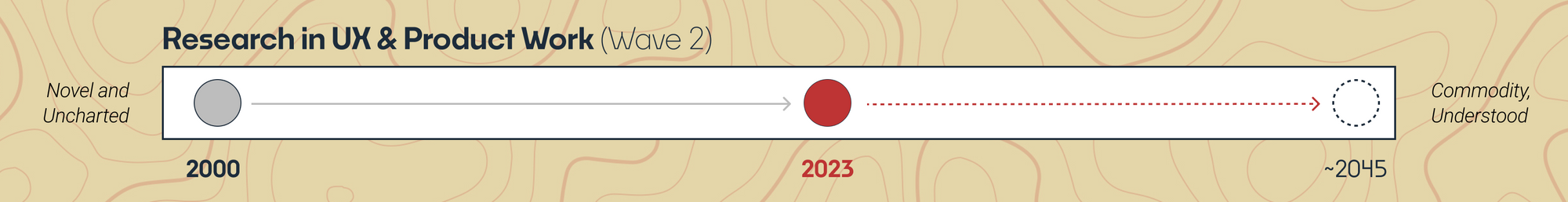

Wave 2 - The Product Wave

The Product Wave has been building for two decades and is growing rapidly towards its peak, moving from design methods and UX into product management. This is where we're playing and evolving right now: organizations investing in in-house capability, vendors rapidly deploying new products, consultants offering project packages, and conferences offer content for training and discussion.

It's also a place of struggle and internal division.

There's known value here, but no shared and understood model of how research work works in the product-sphere. The cadence of project-based research, our dominant mode of Wave 1 and early Wave 2, does not fit inside the faster, continuous cycles of product delivery. The challenge presented to research-as-an-industry in this wave is the integration of our work into repeatable and successful practices that not only fit into, but actually accelerate product decision cycles.

In this wave, we grapple with product strategy as it explores product practice, but don't reach into the business itself.

Wave 3 - The Strategy Wave

The Strategy Wave will see research operate at a business level, and the work will consume the outputs of Product Wave research. Its grounding frames are consolidated sets of user needs that extend into organizational composition and the market landscape.

The work here is custom-built, still carried out by "explorer" or "pioneer" mode practitioners. The position of research is nascent because the work itself — the practices we will co-evolve with — is nascent.

For now, we speculate and experiment in an unstable environment, pay attention to the current building blocks and industry motion, seeing what unfolds as the mystique of strategy breaks down (“that’s MBA stuff,” “that's what the big consultancies do”) and its tools are more widely accessible.

Look at these waves as prevailing modes of thought-and-action in industry, with research as a set of adjacent and co-evolving practices. In each wave, research will shape itself differently, because in each wave the context it's being deployed in is different.

We go a bit deeper into each wave, now, looking at the forms of work that research co-evolves with, the state-of-play right now, and some of the major ideas that have shaped their evolution.

Wave 1: 1980 to ~2030

The first wave was borne of an academic view. Human-Computer Interaction (HCI) research considers users' cognitive capabilities as they interact with systems, and the structure of those systems — from interface down to information architecture — attempting to optimize the flow of users accomplishing tasks, in order to meet goals.

Ease-of-interaction (not design-of-interaction: wait for Wave 2) was the primary concern, built on a background of goals modeling and fine-grained interface-interaction predictions.

By the mid 1980s, concerns of usability – and testing it – moved from HCI research into commercial work. Jared Spool recounts one of the first usability tests in the early '80s — "kidnapping a janitor's closet" to create a custom-built lab with a two-way mirror, requiring a pass to bring a camera into the premises. Ten years later, Nielsen & Norman would publish Usability Engineering (1993), and a year after that, the first edition of Handbook of Usability Testing (1994) would help to drive the work into clearer and better-understood practices.

In 2010, for me, it was still custom work: paper-based mobile app prototypes, Craigslist-ad user recruiting that pointed to separate survey provider, manual phone or email follow-up for scheduling, in-office test sessions, cash incentives in an envelope, webcam input recording programs, and unfortunate hours of clipping quotes in Quicktime. A few agencies with permanent usability labs ran tests at high rates our team couldn't afford; within the next few years a number of tech companies would have their own on-premise usability rooms and dedicated lab space.

Today, the core work of usability itself, if not its associated practices, is a commodity platform. Building your own usability test lab is a bad idea if you're deploying on common platforms like apps and the web. We can sign up for services that take standard input — a link, a set of questions, a screener — and receive video recordings of participant-interaction to learn from.

The research work of Wave 1 research is shifting and re-consolidating into an accessible formula-to-be-applied by anyone with a website or app and access to the internet. It leaves the domain of experts or professionals in research, becoming a formula-to-be-applied with expected results.

Except for vendors with volume plays and specialists in special markets, the value to be gained here is decreasing as the wave diffuses into the background of our work. A long tail will remain, as no wave is distributed evenly... but watch: it seems quite likely that language model AI will move up the stack into pattern matching and basic synthesis, rapidly leveling the playing field.

Another thread, borne of HCI and Usability, moved beyond the surface ease-of-interaction consideration. Hugh Beyer and Karen Holtzblatt characterized the design practices associated with Contextual Inquiry in Contextual Design (1997). Design in software started to use the language of customers and identify the models of user work that could drive not-just interface level design but also the design of the larger system itself: this was the point of emergence for Wave 2 research activity.

Wave 2: 2000 to ~2045

The humanizing Product Wave grew from the idealism of User Experience. We can’t just design systems with the right affordances to help users pass usability tests and optimize those systems to success.

Design and product team with larger goals than user-task-completion, and a business to answer to, are working in the Product Wave. Product practices are evolving rapidly, and research is struggling to break from its roots to match the new pace.

The User Experience movement started with the idea that we could make better, more humane software, and even more human organizations, combining intentional Design with the human-centered research methods of Usability and HCI. Jesse James Garrett's Elements of User Experience diagram (2000) led to the book in 2003, and offered a new framework for understanding what User Experience was working with. Alan Cooper's The Inmates are Running the Asylum (1999) laid out the foundational problem — for all our theory, we were still producing bad software — and offered an answer, a means to model and encapsulate user needs and develop for them.

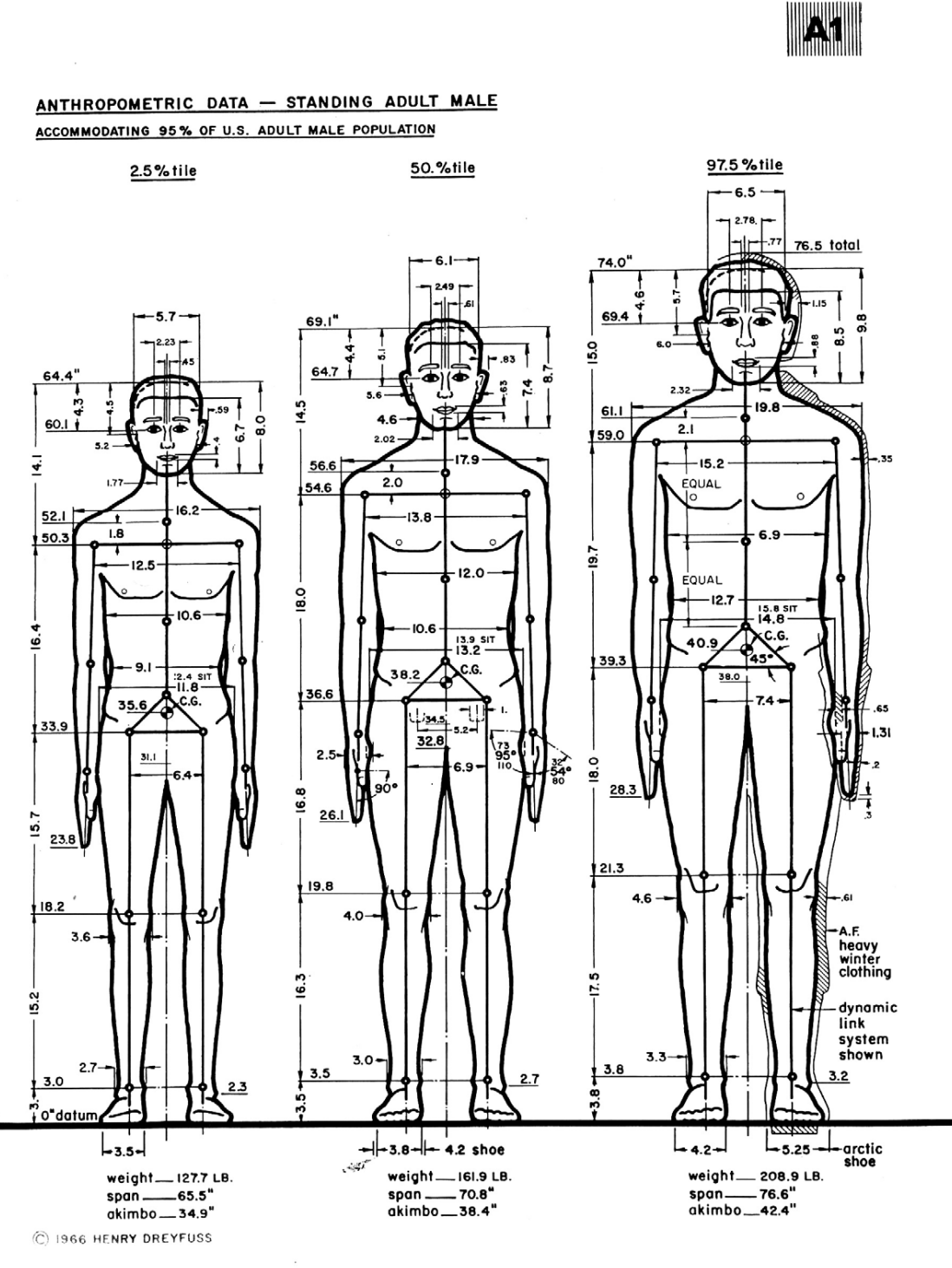

Building models of users (Beyer & Holtzblatt's models of user work and flow, Cooper's models of user goals and behavior) to drive design was not new. Henry Dreyfuss wrote about a human-centered process for industrial design in Designing for People (1955), and published the corresponding human factors user-models in the Measure of Man (1966), later updated to The Measure of Man and Woman. I believe how we use models as visual, shared, and tangible places of learning and assumption is a core research competency that remains largely unexplored in Product Wave research work.

What Cooper began in Inmates, he carried forward to About Face (1995, with Robert Reimann and David Cronin), in the larger frame of interaction design. Interaction was a "higher order" (cf. Buchanan) of design than industrial design. It required new types of user-models (behavioral) to design new kinds of things (activities). Dreyfuss' human-scale ergonomic data will help us design a bus, or a train car — for example, it matters how tall and wide people are so we can accommodate them — but that's not the kind of information that will help us design software. To understand people in new ways, we would need new and updated forms of research. Research practice would co-evolve with the activities supporting interaction design, and 'user research' was gaining traction as its label.

Mike Kuniavsky laid the cards on the table in 2003, with Observing the User Experience: A Practitioner's Guide to User Research, a comprehensive survey of research methods as they pertained to interaction design. Kim Goodwin built on Cooper's work and published an end-to-end approach to iterative interaction design, rooted in research and the development of behavioral user models, personas and scenarios, in her Designing for the Digital Age (2009).

And in 2013, the professional mindset and activities that constitute user research gained further clarity and more accessible grounding perspectives in Erika Hall's Just Enough Research (2013) and Steve Portigal's Interviewing Users (2013). Through the mid 2010s, these last three would become primary sources for my work of building out research in organizations who had never seen a researcher before.

At the same time that user research was consolidating out of UX and interaction design, product managers were developing their own theories and practices of users and experience. Early twenty-teens product zeitgeist was "getting out of the building." Rigor didn't matter so much as contact and baseline exposure to context. We needed customers and we needed insights.

My Director of Product Management handed me Steve Blank's Four Steps to the Epiphany (2005) in 2011 as the bible for customer work — customer discovery, customer validation, customer creation, customer building. It was a process for operating a product business from a customer-oriented view, with a strong search-and-iterate startup perspective. (Later I'd come to find that our organization was incapable of operating in this manner.) And it offered a business lens, the ability to zoom out to a higher product-oriented perspective; the target wasn't designing interactions and ensuring good experiences, it was also making sure the product and the customers fit.

We gained more structured means of 'talking to customers' from business and innovation thinking. Tony Ulwick's Outcome-Driven Innovation was popularized as Jobs to be Done, in Clayton Christensen's The Innovator's Solution : Creating and Sustaining Successful Growth (2005) The answer to the dilemma focused on customers in context and looked to encapsulate the outcomes and progress they wanted to make. (It was this thinking that also gave us Theodore Levitt's ubiquitous, insightful, useful, and awful quote, "People don't want to buy a quarter-inch drill. They want a quarter-inch hole!")

"Lean" and "continuous" ideas built on these frames, accelerating the pace of customer-oriented product development well beyond the pace of design-based research. And the more important and foundational a study seemed, the longer it would take, only increasing its disconnect from the product development cycle, while the dogma of universally-applied agile supplies a constant source of fuel.

Teresa Torres' product work, formalized in Continuous Discovery Habits: Discover Products that Create Customer Value and Business Value (2021), takes the pragmatic approach of creating research practice from the ground up, inside of existing product cycles. The dutiful researcher, trained up in late Wave 1 or early Wave 2, will object to a lack of structure and formal process. But if formal research projects don't fit the work, talking to any customers (with basic interviewing skills, and an eye for problem-/solution- space distinction) proves infinitely more valuable than talking with none of them.

The work of research in the Product Wave is unbundling our practice from projects, and evolving the work to drive new value within the continuous stream of product work. What does research provide that product teams (with good-enough interviewing skills and existing discovery practices) aren't realizing, or can't achieve, on their own? That's the game, for the next few years.

[Editor's note, November 2023: see also Continuous Discovery for Product Teams on this site, for a deeper look at Wave 2 research.]

And the pieces are coming into place. The activities required to execute our work are consolidating into known forms that will serve as building blocks for the evolution of Product Wave research. We see maturing interview capability, well-understood and structured formats for user insight, design and product theories oriented on a user/customer perspective, collaborative tools for building shared understanding, and ever-shrinking loops of execution and learning. It's an exciting and turbulent time in Product Wave research.

Even as our practice grows and evolves, there is a wall this wave won't breach. Research in the Product Wave does not have the scope or the tools to address higher-order organizational strategy about which spaces we're playing in. It's rare that organizations themselves have this higher-order conceptual view, the why of "should we move here instead of there" before approaching the work itself.

Lack of strategic sight will destroy a product effort or a research direction with a quick whip of executive will, or the shackles of board-enforced priorities. Without a clear rationale for making our moves, it's hard to learn from them, and harder yet to hold a high bar for the decisions that change them.

Researchers (and designers, and product managers, and engineers, and marketers, and executives) with enough stored pain from failed and curtailed product efforts, plus the fortitude to focus and learn from them, are eventually drawn up to the next wave.

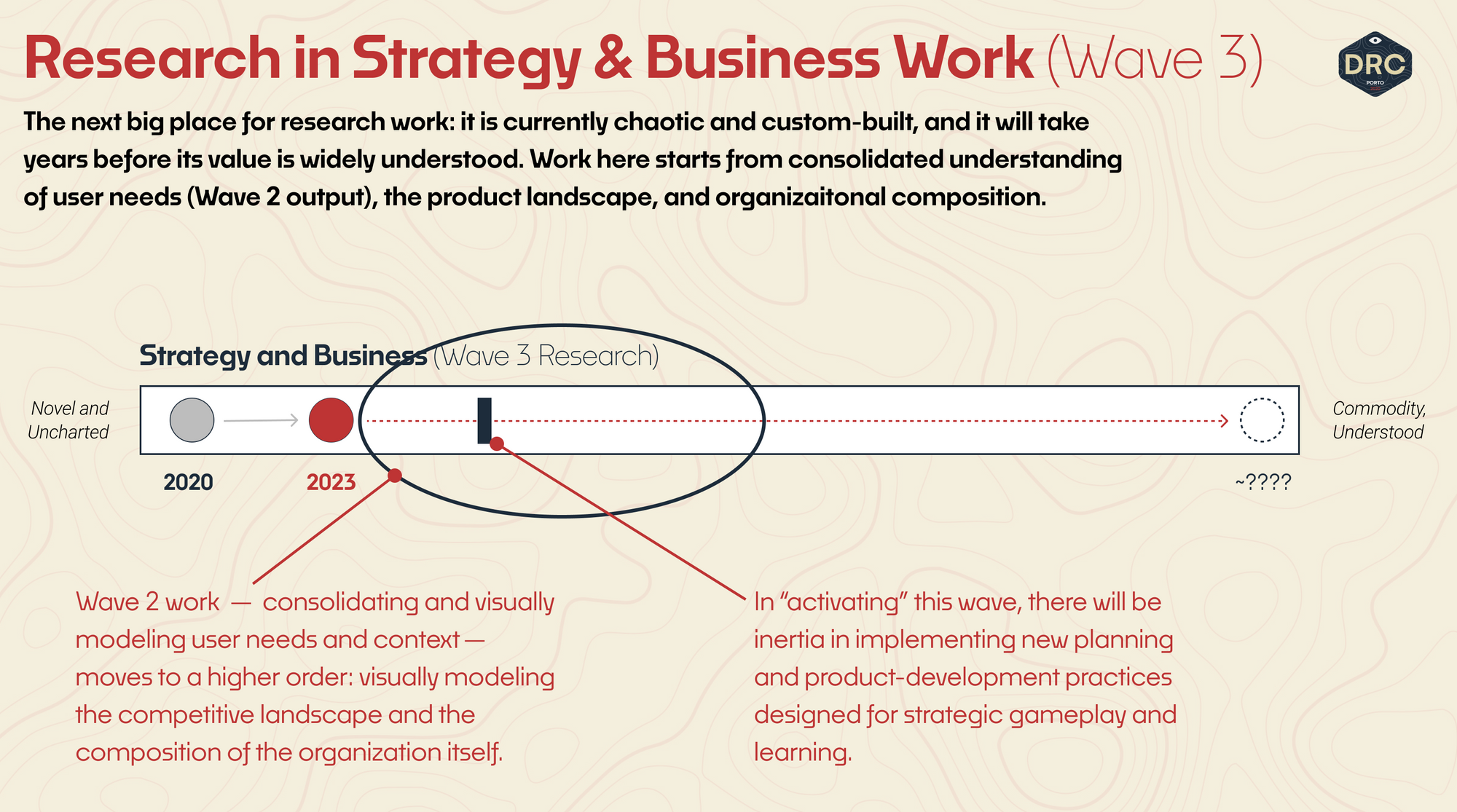

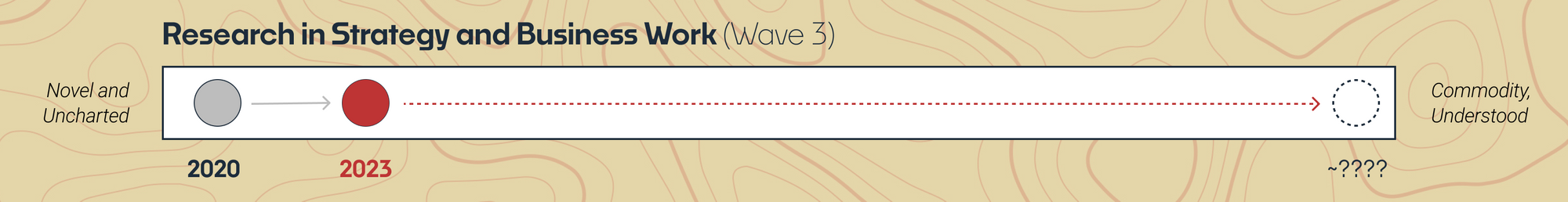

Wave 3: 2020 to ~????

The Strategy Wave is one of gameplay. Strategy Wave research emerges from Product Wave research, and pulls in the wider scope of business, market landscape, organizational structure, and planning. The full scope of the work and its possibilities are unclear—it's all being explored and custom built at this stage.

The research work will require the same kind of structured modeling for shared understanding and learning that we employ with user needs in the Product Wave, but operate on a higher context at longer time scales. What's modeled are those needs, the value chains that support them, and the larger market landscape they sit within. The focus is on strategic gameplay, and that gameplay will push organizations to plan and operate strategy cycles in new ways.

Strategy work in business evolved from roots in process-operational efficiency and accounting, growing its awareness into management, market, customer segmentation, and technology.

As a school of business thought, "management" as an element of strategy has been in focus for over a century, with Peter Drucker, Tom Peters, W. Edwards Deming, and Jim Collins as its primary scions. And a surprising amount of this thinking was built on Mary Parker Follet's original work in management and organizational theory, way back in the 1920s.

Outside of the organization itself, strategy also had to understand how the market operates. Michael Porter's Five Forces model, introduced in Competitive Strategy: Techniques for Analyzing Industries and Competitors (1980), laid out an MBA-favorite view. Organizations could determine their strategy through the analysis of five forces at play in the competitive environment: Threat of new entrants, Threat of substitute product or services, Bargaining power of supplies, Bargaining power of buys, and Rivalry among existing competitors.

But strategy wasn't just management, or seeing forces in the market. It was also how you learned from the market. Peter Singer's Fifth Discipline (1990) broke ground on organizational learning as a competitive advantage.

Then Geoffrey Moore's Crossing the Chasm (1991) focused on the customer side of technology strategy, framing different modes of marketing and product development based on different phases of the customer adoption curve:

- Innovators

- Early Adopters

- (the-chasm-is-here)

- Early Majority

- Late Marjority

- Laggards

Christensen's Innovators Dilemma (1997) framed strategy in technology as the work of disruption, cautioning against the danger of organizational inertia bred from past success (the-dilemma-is-here, reframed in Wardley's terms). And A.G. Lafley and Roger L. Martin took on strategy in 2013 with Playing to Win: How Strategy Really Works, offering strategy as a coordinated and integrated set of five choices: decide on your winning aspiration, where to play, how to win, your core capabilities, and your management systems.

Each thread — markets, operations, innovation, customers, management, excellence, and strategy itself — is one interconnected and intertwingled part of the larger writhing mess that constitutes organizational strategy. What we lack, in practice, is a way to see through this impenetrable and seemingly inaccessible mess: a working theory that explains how these ideas talk to one another and offers a means to make informed, context-specific strategic moves. We've been playing the game without seeing through to the game board.

Modern strategy's genesis begins with the Wardley Map framework: a strategy framework that contends that forces of competition which drive evolution, from novel to industrial, make up the landscape of the game. This is a new kind of material for research to work with.

Just as we create a means of challenging assumptions and learning through visual models of user context in Product Wave research, Strategy Wave research will see us visually model and challenge our ideas about the strategic product landscape.

The three waves depicted in this essay, and our discussion of their evolutionary state, offer a narrow and rudimentary example of Wave 3 research.

This visual expression of the game allows us to challenge our assumptions about the context, execution, and implications of strategic moves. The pieces on the board are value chains that flow down from user needs, and the entrypoint for research are the Product Wave user needs and customer journeys that anchor this point of view.

As organizations evolve into strategic gameplay, a practice of strategy will evolve, and its consumption of Wave 2 research is the sensing mechanism we use to understand its trajectory. And as cycles of strategic practice evolve and accelerate, the best opportunity* (maybe — we'll map this assumption in later edition) for research to co-evolve into the strategy wave is building a means of structured learning and contextual gameplay insight that fits inside the cadence of organizational strategy.

The strategy sphere is not a place of work that will be "owned" by research, in the same fashion that research doesn't own the HCI and Interface Design practices of Wave 1, or the UX and Product practices of Wave 2.

It's one more socio-technical wave that our practices can co-evolve with. It's still new; there's a lot to explore. And it looks like a fun place to play.

This essay is part of an ongoing exploration into research as it evolves and re-integrates itself into the organization.

For weekly thoughts on the nexus of products-organizations-process-strategy, and updates on larger resources like this, consider joining my newsletter.